Tax filing, proactive planning, year-round support, and strategic guidance — one integrated service.

Tired of only talking about taxes once a year — when it’s already too late to change the outcome?

Take control of the biggest expense you’ll ever have.

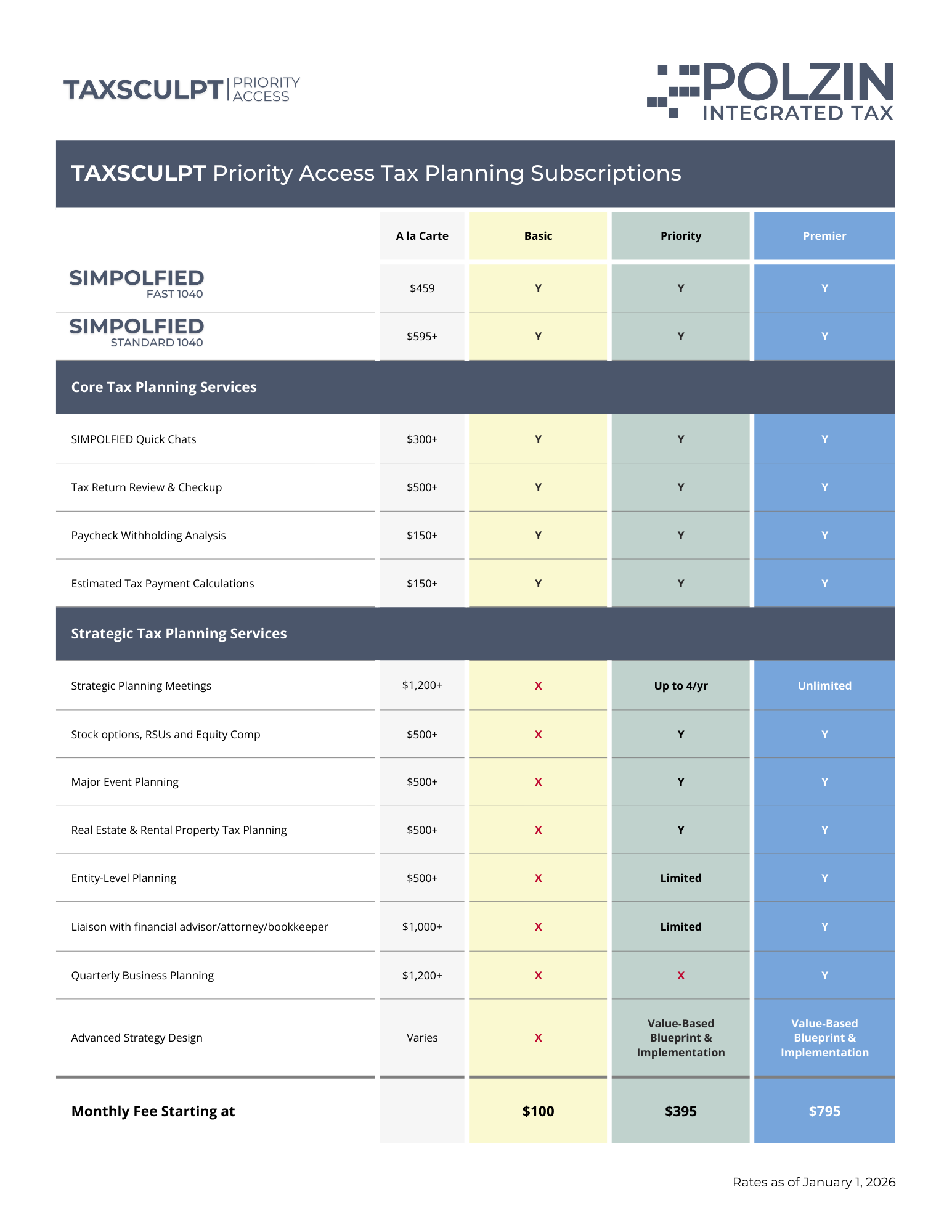

Imagine having a tax team that’s available when you need them—no surprise fees, no extra charges. That’s what TAXSCULPT Priority Access delivers.

Say goodbye to the outdated model of being 'nickeled and dimed' with every call or question.

What’s more, we go beyond tax prep with our mid-year Tax Strategy Sessions, held from May through July. Here’s where we step in early to review your finances—think paystubs, rental income, stock sales, and beyond—to build a customized tax projection. You’ll get a clear look at your annual tax picture months in advance, giving you time to make adjustments if needed. Because April 15 should be predictable, not a day of unwelcome surprises.

With TAXSCULPT Priority Access , it’s about forward-thinking strategies, full transparency, and a commitment to keeping you in control of your financial future.

Frequently Asked Questions About TAXSCULPT Priority Access

Does this include my tax preparation?

Yes — your annual return is included when enrolled in the subscription.

What if I join mid-year?

Your tax preparation fee is billed in full. The planning support fee is prorated for the remaining subscription cycle.

Is this required to work with you for taxes?

No — but most clients choose this service to prevent tax surprises and improve planning accuracy.

Can pricing change during the year?

Yes — but only if your tax situation changes in scope (e.g., new business entity, added rental, new planning structures). Any adjustments are discussed before implementation.

What if I’m an Eight Peaks Wealth Management client?

The level of planning provided in TAXSCULPT is already included for ongoing planning clients. No duplicate subscription needed.

IMPORTANT: With our TAXSCULPT Priority Access, you’ll enjoy routine, complimentary chats for basic tax questions and one annual tax strategy session. While we’re here to guide you, please understand that this access doesn’t include decision-making consultations where we’d provide specific recommendations.

Certain services may fall outside this scope and could require a separate fee. These include:

Handling IRS or state notices for matters not originally managed by us,

Preparing verification letters for mortgages,

Postage and delivery beyond basic letters,

Financial planning or investment guidance,

Setting up or training for accounting software like QuickBooks,

Annual corporate governance tasks, such as filings and resolutions,

Reviewing legal documents (Operating Agreements, Shareholder Agreements, contracts),

Extensive coordination with attorneys or financial advisors, and

Scenario-based tax planning (e.g., selling rentals or business interests).

If a request goes beyond the TAXSCULPT Priority Access program, we’ll discuss it with you in advance to ensure transparency and alignment. You’ll never be billed unexpectedly—any additional services will come with an estimate and your approval first. So, ask away! We’ll let you know if a quick check-in might turn into a more detailed conversation.

Get Your Tax Questions Answered When You Have Them

Understand your taxes better with an annual tax strategy session

Receive tax planning and projections to help reduce lifetime tax liabilities