Your Trusted Partner For Individual Tax Preparation In The Denver Metropolitan Area

Have you been wanting to get more than basic filing from your tax professional?

Now Accepting New Tax Clients for 2025 Tax Filing

Secure Your Spot for 2025 Tax Prep

We’re welcoming new clients who want expert support—before things get busy.

Spots are limited—start early and file with confidence.

Easy Onboarding Through Our Secure Portal

We make getting started simple. Our online client portal is built to save you time and eliminate confusion. Once you're invited in, you'll complete a guided intake form and upload your documents in one secure location—no scanning, no shuffling paperwork, and no chasing down missing items.

The process is designed for clarity, speed, and peace of mind—so you can focus on life while we handle the filing.

Expert Tax Prep by a Tax Professional Who’s on Your Side

You’re not just getting a basic tax preparer—your return is handled by a seasoned IRS Enrolled Agent as well as a CERTIFIED FINANCIAL PLANNER® professional who understands the big picture.

Enrolled agents (EAs) are the only federally-licensed tax practitioners who both specialize in taxation and have unlimited rights to represent taxpayers before the IRS.

Virtual Tax Prep Experience That Fits Your Life

No office visits, no waiting rooms, no printing piles of paperwork. We offer a fully virtual tax prep experience from start to finish. Meet with us online at your convenience, securely upload documents through our portal, and get expert support without ever leaving your home.

It’s tax filing, modernized for your busy schedule. Returns are e-filed for faster refunds.

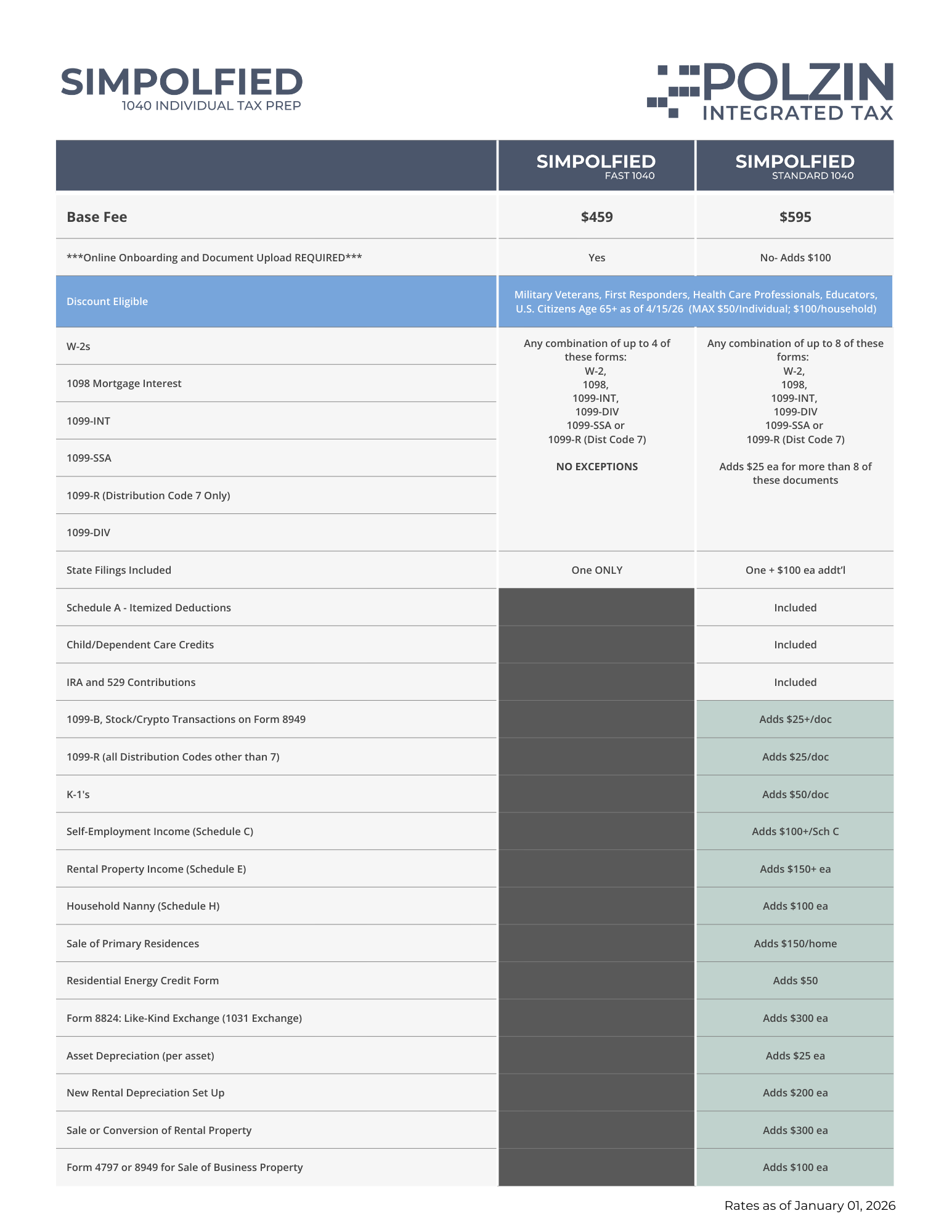

Transparent, Tier-Based Pricing—No Surprises

No hourly rates. No hidden charges. Just clear, flat-fee pricing based on your tax situation.

You'll know your fee before work begins, and we’ll never surprise you with add-ons or upcharges.

Our goal is to keep things simple and predictable—so you can plan ahead with confidence.

Understand your taxes and your financial future better than you ever have before.

Ready to get started? Here’s what to expect.

STEP 1

Request Access to the Secure Online TaxDome Portal

Click the “Get Started” button to request access to your secure client portal. We’ll send you everything you need to begin.

*Prefer to schedule the Introductory Call first? Skip ahead to Step 3.

STEP 2

Complete Your Prospective Member Organizer

Fill out a short, guided form that helps us understand your tax situation and determine if SIMPOLFIED 1040 is the right fit.

STEP 3

Schedule Your Complimentary Introductory Call

We’ll review your intake and meet briefly to answer questions, explain next steps, and ensure everything’s aligned before moving forward.

STEP 4

Review & Sign Your Client Agreement and Get Started

Once we’re aligned, you’ll review and sign a simple engagement letter to make it official—then we’ll get to work on your return.

A Simple, Transparent Approach to Pricing

SIMPOLFIED Fast 1040

For clients with straightforward returns who desire the expertise of a tax professional at a flat price.

Fee: $459

SIMPOLFIED Standard 1040

For clients with more complex returns and small businesses. Price will increase based on complexity.

Fee: Starts at $595

SIMPOLFIED Student

Designed for students and dependents age 24 or younger with uncomplicated tax needs and a connection to a parent’s return.

Fee: Starts at $250 (typically $250 - $400)

We Proudly Offer Discounts For: Military Veterans, First Responders, Healthcare Professionals, Educators, and U.S. Citizens Age 65+

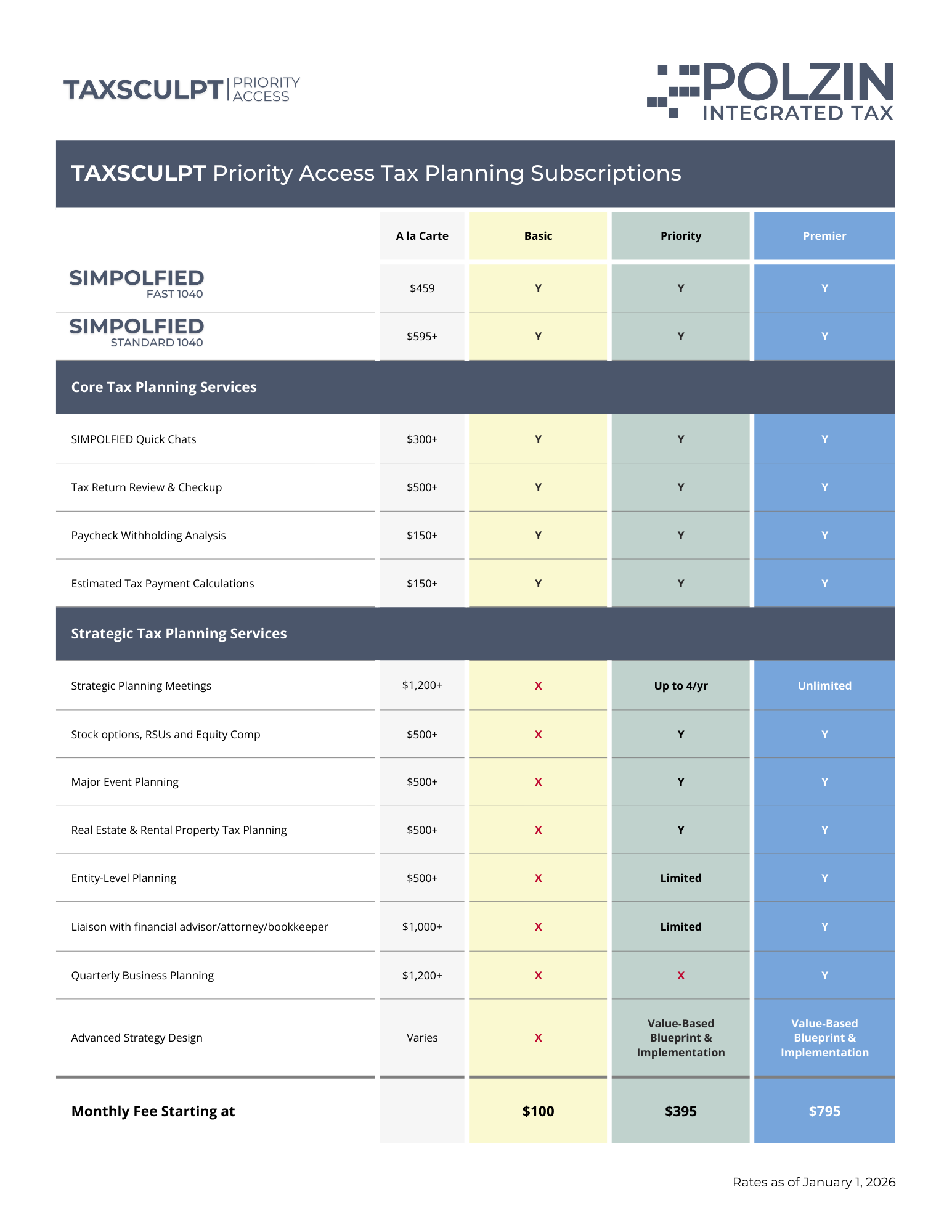

Interested In Year-Round Tax Support?

TAXSCULPT Priority Access

For clients desiring year-round tax support, planning and return filing in one easy subscription.

Pricing: Starts at $100/mo

Looking for even MORE value?

Don’t anticipate your tax situation changing?

If your tax situation doesn’t change from year-to-year, SIMPOLFIED FeeLocker can lock in this year’s price for your first three returns with us.

Additional terms apply.

We Value Your Referrals!

As a token of our appreciation, current members may receive a $25 gift card for each new tax client they refer to us who completes their tax filing.

Maximum 10 referrals per calendar year.