Cost Segregation Studies That Unlock Immediate Tax Savings—Keep More of Your Money

A powerful tax strategy for real estate owners who want to reduce taxes now, not later

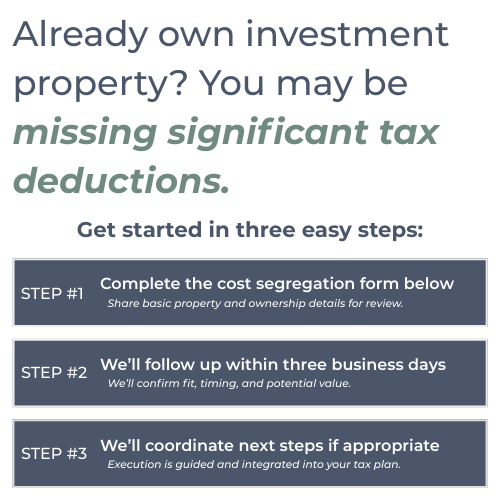

Is Cost Segregation Right for Your Property?

A cost segregation study allows real estate owners to accelerate depreciation, increase near-term cash flow, and significantly reduce federal and state income taxes. When done correctly—and supported by engineering-based analysis—this strategy can generate five- or six-figure tax savings in the very first year. At Polzin Tax & Business Advisors, we help property owners determine whether cost segregation makes sense, coordinate compliant studies, and integrate the results into a broader tax strategy.

What Is a Cost Segregation Study?

A cost segregation study is a detailed analysis that reclassifies portions of a building from 39-year (commercial) or 27.5-year (residential) depreciation into shorter-lived categories such as 5-, 7-, and 15-year property.

This acceleration allows you to:

Front-load depreciation deductions

Offset ordinary income or passive income

Improve after-tax cash flow

Potentially generate or increase net operating losses (NOLs)

Cost segregation is explicitly recognized by the Internal Revenue Service when supported by proper documentation.

Who Should Consider Cost Segregation?

Cost segregation is typically most effective for:

Commercial property owners

Short-term rental owners (Airbnb / STRs)

Multi-family investors

Business owners who purchased, built, or renovated property

Properties purchased or improved after 2018 (bonus depreciation rules)

Typical qualifying thresholds:

Purchase price or construction cost of $500,000+

Positive taxable income to offset (or future income planning)

Long-term ownership horizon (not immediate resale)

Even properties purchased years ago may still qualify through a look-back cost segregation study.

Not All Cost Segregation Studies Are Created Equal

Poorly executed studies increase audit risk and can unwind years later.

We focus on:

Engineering-based studies (not rule-of-thumb)

Full documentation support

Proper asset classification

Integration with your overall tax picture

We do not push cost segregation when it doesn’t make sense.

Cost Segregation FAQs

Is cost segregation risky?

When done correctly and supported by engineering documentation, it is an established and accepted tax strategy.

Can I do cost segregation on an older property?

Yes. A look-back study may allow you to “catch up” missed depreciation without amending prior returns.

What happens when I sell the property?

Depreciation recapture may apply—but this is often outweighed by the time value of tax savings and reinvestment benefits.

Will cost segregation increase my audit risk?

When supported by proper documentation and implemented correctly, cost segregation is a well-established tax strategy. The key is ensuring the analysis is thorough and compliant.

Can cost segregation be used alongside other tax strategies?

Yes. Cost segregation is often most effective when coordinated with broader tax planning strategies and income timing decisions.

How long does the cost segregation process typically take?

Timing varies by property and complexity, but once eligibility is confirmed, the process typically takes several weeks from initial review to completed integration into your tax filings.