Frustrated by Tax Surprises Even Though You Have a CPA?

A Clear Proactive Approach for Busy Highlands Ranch Professionals and Families

Get Started Now — 2025 Tax Filing Availability Is Limited

To ensure a high-touch experience we only accept a limited number of new tax clients each year.

We serve Highlands Ranch taxpayers and business owners who want more than a last-minute filing.

Our Highlands Ranch clients receive integrated tax, business and financial planning conveniently within one firm.

Welcome to Polzin Integrated Tax Solutions — we are a Colorado-based firm delivering integrated tax preparation and advanced tax strategy services to the Highlands Ranch community with integrity, experience, and loyalty at the core.

Highlands Ranch is home to many busy professionals, business owners, and families who want their taxes handled correctly, efficiently, and without surprises. If you’ve ever felt unsure about why you owed—or whether your return was truly optimized—you’re not alone. Our approach focuses on clarity, proactive planning, and predictable outcomes, not last-minute filing.

Our clients in Highlands Ranch include educators, military veterans, entrepreneurs, small business owners, and high-net-worth families who value proactive advice and personalized support.

We make tax season simple with convenient virtual onboarding and streamlined preparation services—so you can handle your taxes without leaving home. For those with more complex financial needs, our TAXSCULPT Advanced Tax Planning program provides sophisticated, year-round strategies to minimize taxes and maximize long-term wealth.

Brett R. Polzin, CFP®, EA

Founder & Chief Tax Strategist

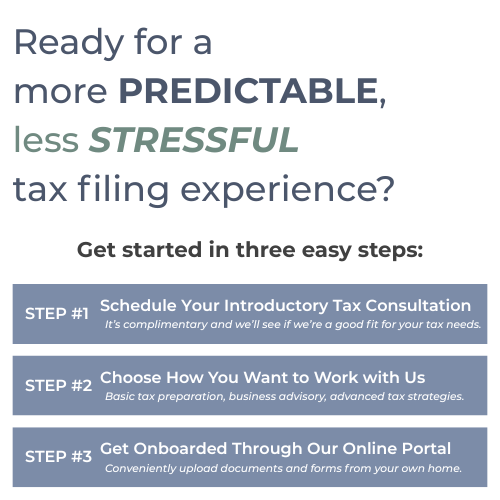

A Calm, Proactive Approach to Tax Preparation

Most people don’t mind paying taxes—they mind being surprised by them.

Unexpected balances, unclear explanations, and last-minute scrambling create unnecessary stress. Our tax preparation process is designed to replace anxiety with clarity, structure, and predictability, so you know what to expect before tax season is over.

Why Tax Filing Alone Often Leads to Surprises

Most tax problems don’t come from mistakes — they come from missing planning.

Many Highlands Ranch taxpayers work with a CPA or tax preparer, yet still experience:

Unexpected balances due

Underpaid estimates

Missed planning opportunities

A reactive, last-minute filing process

Tax filing looks backward. Predictable outcomes come from planning ahead.

Our approach is designed to replace reactive filing with proactive tax planning — so you’re not left guessing each year.

What a More Predictable Tax Experience Looks Like

A predictable tax experience doesn’t mean complexity — it means clarity.

Our process focuses on three core areas:

Filing Accuracy & Risk Awareness

Ensure returns are complete, accurate, and aligned with your full financial picture.Proactive Tax Planning Opportunities

Identify strategies before year-end — not after it’s too late.Cash Flow & Estimated Tax Alignment

Reduce surprises by aligning withholding and estimates with real-world income.

When these three areas work together, tax season becomes calmer, clearer, and far more predictable.

Who This Is a Good Fit For

We work best with Highlands Ranch clients who value planning and clarity over last-minute filing.

This includes:

Small business owners and self-employed professionals

High-income W-2 earners with complex tax situations

Families who want fewer surprises and better decisions

Individuals seeking proactive guidance — not just compliance

If you’re simply looking for the cheapest option, we may not be the right fit — and that’s okay.

We intentionally limit the number of tax clients we work with to maintain a high-touch, proactive experience.

Common Questions We Get

Choose the Level of Tax Filing Support That Fits Your Financial Life

SIMPOLFIED 1040 Individual Tax Prep

One-time tax preparation. No ongoing planning required.

Best For:

Students • Early-career professionals • W-2 households • Simple returns

Includes:

Annual federal & state tax return preparation

Secure document portal

Optional review call

Transparent, three-tier pricing model based on complexity

One-Time Preparation & Filing Fee: Starts at $459 (finalized once your fee grid is confirmed)

TAXSCULPT Tax Planning Subscriptions

Annual tax preparation + year-round strategic planning.

Best For:

Retirees • Rental owners • Equity compensation • Business owners • Complex tax situations

Includes:

Annual federal & state tax return preparation

Priority access via email/phone

Up to 4 strategic planning touchpoints (or unlimited in Premier)

Estimated tax planning & tax projections

Major financial event review

Annual Subscription: Starts at $79/mo

Want more details about our pricing?

Click the below to learn more about our fees